Teaching pricing strategy

Pricing is one of the most important but least understood marketing decisions. Pricing strategy is how firms capture the value they have created, and optimize their profits. But pricing decisions do not need to be mechanical (e.g., set at say, +15% above costs) or driven by competition (let’s match, or be cheaper than our competitors), but rather driven by a careful analysis of customer data.

If you are teaching pricing strategy these are the Enginius models and case studies we recommend for you…

Not familiar with Enginius yet? Click here to discover how Enginus can boost your teaching.

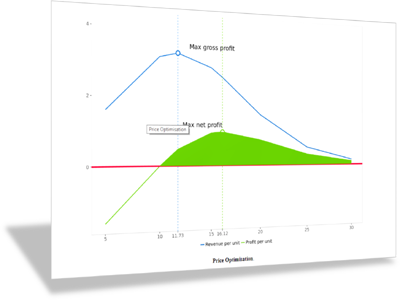

Price optimization

Obviously, the price optimization module in Enginius, built upon the Gabor-Granger method, is a must-have model in your arsenal. It will show that simple survey data about customers’ willingness-to-pay can be transformed into powerful price elasticities and demand functions, leading to the estimation of optimal price points for products or services, as well as powerful price simulations.

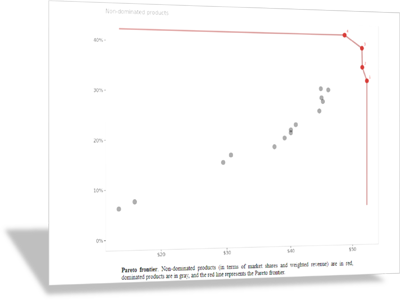

Conjoint analysis

While conjoint analysis is one of the most common methods used in market research, it is also a powerful price optimization tool (if price is set as one of the attributes that describe the product). By analyzing customers’ partworths, and showing that one can quantify how customers trade off between price and other product attributes, conjoint analysis allows students to run powerful market simulations of price changes and new product launches. The Pareto frontier feature in the conjoint module also allows students to visualize the kind of choices companies have to make between market shares and profit.

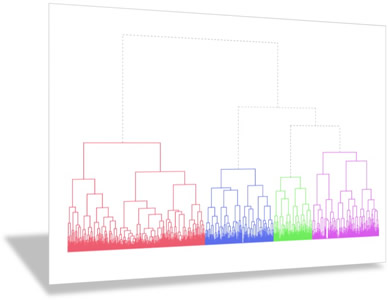

Segmentation

A sometimes overlooked feature of conjoint analysis is that preference partworths can easily be segmented, which, in a pricing strategy course, leads to interesting insights, such as the identification of groups (segments) of customers with varying willingness-to-pay. The identification of segments leads to core concept such as price discrimination and segment-based pricing. The Dürr case study, which allies conjoint and segmentation, is particularly rich in that context.