GE McKinsey matrix

The GE McKinsey matrix helps managers compare options (e.g., products, initiatives, divisions, segments) on a two-dimensional map, with multiple factors underlying each dimension. Historically, managers used industry attractiveness and business strength to rate company divisions, but the model can be used in a variety of contexts.

What you put in...

- SBU, product, or segment ratings on key attributes

- Importance of these attributes to the firm

What you get out...

- Visual representation of relative attractiveness of SBUs, products, or market segments on a 2-dimensional map

- Sensitivity of map to attribute importance scores

Key features

Dynamic ratings

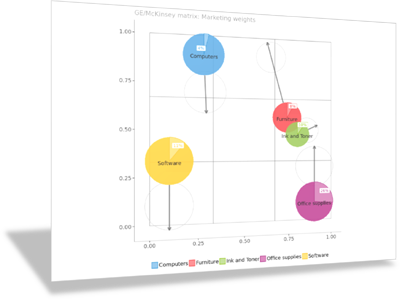

The GE McKinsey matrix can not only map objects (e.g., products, segments or divisions) in a static map, but may also display dynamic ratings if available. That allows you to display historic trends, managerial objectives or projections in a single map.

Market shares

If market shares (or share-of-wallet data) are available, they can be displayed directly in the GE McKinsey matrix.

Multiple weights

Each axis of a GE McKinsey matrix is a combination of multiple underlying factors, each with its own subjective importance. These importance weights can easily be manipulated in Enginius to generate multiple matrices from the same data, for instance by specifying short-term vs. long-term importance of each factor, or by mapping the assessment from the marketing department vs. the one from the sales organization.

About GE/McKinsey Matrix

The GE Portfolio approach evaluates a business on the basis of two composite dimensions: industry attractiveness and business strength. These dimensions, in turn, consist of a series of weighted factors. Both the factor weights and the factors themselves may vary from one application to another; for example, industry attractiveness includes measures of market size, growth rate, competitive intensity, and the like, whereas business strength normally includes such measures as market share, share growth, and product quality. Analysts assign each business a rating for each factor and a weight to each factor. Multiplying the factor ratings by the weights produces a position for each business on the strength/attractiveness matrix.

While designed to assist in the GE/McKinsey approach to portfolio management, this model can be used for any situation where a certain number of items are ranked on two sets of weighted factors. Optionally, multiple sets of weights can be used.

The GE Portfolio approach helps firms answer such questions as:

- On which products, offerings, or divisions should we focus our efforts?

- What method can we use to assess and understand the weights that various members of the management team assign to different dimensions?

- How can we reconcile different points of view?